Is College Worth It?

September 6, 2019

Tensions continue to heighten for students and parents around what to do about college and how to finance their education.

This article was first published 06 September, 2019 on LinkedIn.

Tensions continue to heighten for students and parents around what to do about college and how to finance their education. Once a secured differential, today the college worth and lifetime wage premium is under threat and is impacted by the way that students finance their education. For some students, Income Share Agreements (ISAs) have the potential to convert college, graduate and vocational education, into a higher yielding financial and life investment than if funded via traditional student loans.

Since the end of World War II, most Americans have believed that college is a key catalyst to fulfilling their American dream. At large, college education became a desired pathway associated to improvements in quality of life, income levels, and contribution to society. As a result, during the last seven decades, college enrollment has expanded from an exclusive “happy few” to the mass market.

Today, students and parents are increasingly questioning whether the costs and sacrifices to become a college graduate are worth it. This conversation holds true at dinner tables, regardless of individual and families’ socioeconomic class or cultural background, educational, professional, and personal aspirations, and immigration status or race. This tension between moral duty and financial reality, which is well described in this New York Times

article, intensifies when mixed with students’ aspirations and potential.

Factors driving this conversation include, but are not limited to:

- Escalating and high college costs. Forbes America’s Top Colleges 2019 suggests the average total annual cost in one of the top 650 US educational institutions is $45,000.

- Low completion and graduation rates. Close to 45% of students enrolled in college fail to graduate within 6 years [1].

- Alarming student debt figures. Total student debt outstanding reached $1.6 trillion in the 4th quarter of 2018 with a 10-year CAGR of over 9% – 2.2x the rate of auto loans growth [2].

College Value Premium

Using available College Board data, I analyzed median earnings by education level and gender [3]. Overall, college graduates earn close to $20,000 more than those with some or no college, or associate degree.

The results also show a wage gender gap between median salaries of men and women, regardless of their educational level. It also hints that women see larger benefits in increases in median earnings from a college education than men.

It Matters How You Get There

So, is college worth it?

Forbes

emphatically says yes. Liberty Street Economics, a blog featuring insights and analysis from the New York Fed also says yes, though suggests that for some students the costs outweigh the benefits. Data from the Bureau of Labor Statistics, which compiles weekly earnings of wage and salary workers, implies a yes - full-time workers age 25 and over holding at least a bachelor’s degree report median weekly earnings of $1,357 compared to high school graduates (no college) of $751.

More and more people are on the “it depends”, “for some”, camp. Ryan Craig, Co-Founder and Managing Director of University Ventures, suggests in his book, "A New U - Faster + Cheaper Alternatives to College” a 2x2 school matrix with a selective or nonselective X axis and an affordable or not affordable Y axis. It forces students and parents to discuss education outcomes like student debt, post-graduation median salaries, and underemployment. Alternatives to College

such as vocational, skills training organizations, paired with preparation and placement with employers, are creating pathways for job opportunities that are in demand and unmet today – according to the Bureau of Labor Statistics there were 7.3 million job openings as of the end of June 2019 [4].

I am part of the second group, but most importantly, as each student considers whether college is still worth it or not, I believe they should have access to transparent, comparable information with regards to the types of aid and available financing tools to fund college education.

Introducing ISAs into the discussion of the once stable, secured college worth and lifetime wage premium, invigorates the conversation. In a research paper published last year, the Jain Family Institute

delves into the returns profile of a college education based on the financing instruments used. One of their key findings is that for the average American student, who requests approximately $30,000 for his or her college education, the lifetime college value and wage premium is reduced by 11% with an ISA compared to 25% with a student loan.

More data and research around these types of discounts would shed further light on the impact that student loans and ISAs have on the value of college for students. It seems to me, that one way for ISAs to earn their stripes is for them to generate robust evidence that when structured properly, they have the potential to make college, graduate and vocational skills-based education, a higher yielding life and financial investment than if funded via traditional student loans.

---

Update on 29th October, 2019

Click here

to see CNBC's video clip on this same question, "Is College Worth It", featuring Sheila Blair, Former Chair of the Federal Deposit Insurance Corporation

(FDIC) and John Hope Bryant, Founder, Chairman and CEO of Operation Hope.

-------------------------------------------------------------------------------------------------------------------------------------------

[1] Christensen Institute, “Unlocking the potential of ISAs to tackle the student debt crisis”, Aug 2019.

[2] U.S. Federal Reserve, G19, April 2019. Own Analysis.

[3] The College Board, Education Pays 2016, Data for Median Earnings (in 2015 Dollars) of Full-Time Year-Round Workers Age 25 to 34, by Gender and Education Level, 1975 to 2015. Own analysis.

[4] Bureau of Labor Statistics, Economic New Release, Aug 6th, 2019.

Just the first word elicits all sorts of reactions. A person in the street may recall the Hollywood movie Oppenheimer featuring the "father of the atomic bomb" for his role developing the first nuclear weapons. Some people will be reminded of the dread and anxiety of the Cold War, and call into question the illusion of calm and comfort today from the existing geopolitical fires lighting up everywhere. Others may think about the status of Non-Proliferation and Disarmament Treaties, the approximately $20 billion the U.S. Department of Energy spends annually on nuclear stockpile stewardship and modernization[1], and or the risks posed by the more than 12,000 nuclear warheads that exist globally[2]. Occasionally, someone may hesitate. Perhaps he came across the recent news about Microsoft 's Three Mile Island deal in Pennsylvania[3], Google 's Power Purchase Agreements with Kairos Power [4], or Amazon 's investment in X-energy [5]. He thinks nuclear fission. Maybe words like Vogtle and SMRs sound familiar. In 2023, the share of U.S. electricity production from nuclear stood at 18% representing 775 TWh. The global share of electricity generation from nuclear was over 9%, measuring 2,686 TWh[6]. ... [CONTINUES] Click here to bypass paywall and continue reading article for free without a subscription.

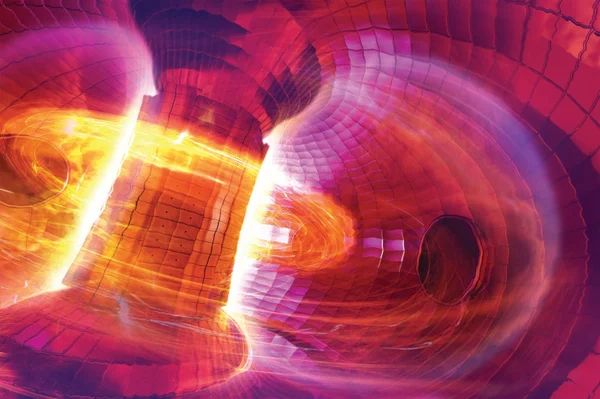

A commercial fusion energy source has never been closer to appearing on the electrical grid. Amazing, major breakthroughs in fusion science and technology are accelerating the potential for fusion energy to transform the global energy market and catalyze an equitable transition to a clean economy. Alongside overcoming significant remaining technical challenges, learning about the massive scale of investment, innovation, and excitement for fusion energy was inspiring. Here are a few of my takeaways from participating in Fusion Energy Week – U.S. Fusion Energy last week: How Fusion Works Fusion is not fission. Fusion binds. Fission divides. Fusion could provide abundant, safe, reliable, zero-carbon energy – 4x greater than fission. Fission faces many challenges, amongst them its destructive potential, global security proliferation risks and oversight, radiation, and nuclear waste. Yes, they share some science and technical (S&T) fundamentals and the word “nuclear”, yet the difference between fusion and fission is not just a linguistic nuance. It is not like thinking of soccer in the US and football non-US. It appears to me it is more like understanding the key differences and distinctions across cue sports: billiards, pool, and snooker. Fusion replicates a natural process that powers the sun and stars. For almost a century, scientists have been trying to replicate this on our planet earth. To do so, scientists bring together two atoms of Hydrogen (H), the lightest element of the periodic table, to create a heavier atom, essentially isotopes of H, deuterium and tritium. Various devices and methods including magnets and lasers are being developed for fusion. The leading concept is the Tokamak , which uses electromagnetic forces to confine very hot (+100MM degrees Celsius), charged, magnetic plasma in a vessel in the shape of a donut. This plasma produces heat which is then run through a turbine and a generator to convert the thermal energy into electricity. Should you want to dive deeper in the science behind fusion, suggest checking out the resources available at the US Fusion Energy website, the Office of Nuclear Energy at the Department of Energy, and Dr. Anne White's, Professor of Nuclear Science and Engineering at The Massachusetts Institute of Technology, explanation of fusion in 5 levels of difficulty published in Wired (magazine). Hats off to anyone who gets their kids to sing along this song – “not an illusion, if we get it just right”. Accelerating Systems Change Systems change in the financing and deploying of clean energy that address climate change and environmental, equitable justice, require a wide range of actors collaborating across their value chains and potentially beyond their interest. More often than not in non-traditional ways. I am excited and interested to see how the Inflation Reduction Act (IRA) federal and state, tax credits and electrification rebates, as well as the Greenhouse Gas Reduction Fund (GGRF) $27 billion, are executed to accelerate energy independence, resiliency, and contribute to a fossil fuel-free world. The fight against climate change demands it is done ensuring fairness and equity, building a diverse and inclusive workforce, and fostering environmental stewardship. However, the fact is that the marginal value one heat pump, one solar roof installation, one induction stove, one electric vehicle or powered two-wheeler, one Energy Savings Agreement, one battery recycling solution, is small relative to its contribution to helping transform the energy transition. It is also very hard to measure. We need to speed up the pace of change. We also need scale. Fusion promises it. Mobilize & Leverage Private Capital from Public Funding The fusion energy market is already seeing a significant amount of investment into private fusion energy companies. According to Global Corporate Venturing and Pitchbook there are now over 40 venture-backed companies developing fusion technology. According to reports from the Fusion Industry Association , over the last decade, more than $4.7 billion of private capital has entered the space. Already the three-year and five-year moving averages of private funding exceed the available public funding sources. Fig. 1 - Private and Public Funding vs. Year. Hsu, S. U.S. Fusion Energy Development via Public-Private Partnerships. J Fusion Energ 42, 12 (2023). https://doi.org/10.1007/s10894-023-00357-9

Life, like fixing your own bike, should encourage our tinkering. Tinker, and after trial and error, we may discover new things = new skills. Then, the ultimate test. Not written or proctored. Doing it. Living it. A maximum effort on climbs cat 2/3/4 and on the downhill at the U.S. Gran Fondo National Series ! Some of the best names in cycling support the U.S. Gran Fondo National Series , the largest and most competitive series of gran fondo cycling events in the United States, including amongst the series supporters and partners, Suarez (Title Sponsor), Wahoo Fitness (Results Partner), UNDRBDR (Official Anti-Chafe Product), Industry Nine (Road Wheels Partner), Shimano (Neutral Support Partner), USA Cycling (US Governing Body) , CTS (Coaching and Training Partner), Ride With GPS (Route Planning & Navigation Partner) and Hammer Nutrition (Sports Nutrition Partner). Make sure to mark your 2023 calendars! It is an amazing riding and racing, experience and organization! “DIY Overhaul A La Carte” Pre Gran Fondo Maryland 2022 Remove/Clean/Install EXISTING Cassette Remove/Clean/Install EXISTING Crankset Remove/Clean/Install EXISTING Pedals Remove/Clean/Install EXISTING Bottom Bracket Remove/Clean/Install EXISTING Headset & Fork Thoroughly Wash/Clean Bike Frame True Wheels (Lateral) Remove/Install NEW Front & Rear Derailleurs/Mechs Remove/Install NEW Chain Remove/Install NEW Handlebars Tape Remove/Install/Adjust/Index NEW Break and Derailleur Cables & Housing Remove/Install NEW Tires Photo Above - First Place Photo, Gran Fondo National Series, https://firstplacephoto.shotsee.com/gallery/granfondomaryland2022

Prowess Global Group S.A.S. informa a la opinión pública que hemos puesto fin a nuestra alianza con Torrot Electric Europa, S.A. Todas las compañías evolucionan y se transforman con el paso del tiempo, y nosotros no somos la excepción. Creemos que el liderazgo en el mundo de las motocicletas eléctricas off-road para niños y niñas comienza con la próxima generación, y por ello estamos contribuyendo a la iniciación y capacitación de más niños y niñas en el motociclismo. Bogotá, D.C. y Colombia, hoy cuentan con la flota más grande de motos eléctricas de Latinoamérica para la formación y entrenamiento integral de niñas y niños en el Motocross y Trial! Cuatro excelentes pistas y escuelas de formación de jóvenes pilotos en el motociclismo, ahora disponen de motocicletas eléctricas para sus clases, cursos y entrenamientos. ¡Contáctalos y visítalos! Agradecemos muy especialmente a nuestros clientes, aliados, concesionarios y equipos comerciales, pistas e instructores, y autoridades distritales, departamentales, y nacionales del motociclismo en Colombia, por haber confiado en nosotros. Con hechos, no palabras, estamos apoyando semilleros y construyendo el futuro de nuestro país , ofreciéndole a los más pequeños, las más amigables, divertidas y seguras experiencias en el mundo de las motos. ¡Mucha suerte y éxitos rodando nuevas aventuras! -------------------------------------------------------------------------------------------------------------- Prowess Global Group S.A.S. today announced that it has terminated its exclusive importer and distributor agreement with Torrot Electric Europa, S.A., to distribute Torrot KIDS electric motorcycles in Colombia. All companies evolve and transform over time, and we are no exception. We believe that leadership in the world of electric motorcycles for kids begins with the next generation, and that is why we are contributing to the initiation and training of more children into the world of motorcycling. Bogotá, D.C. and Colombia, have the largest fleet of electric motorcycles in Latin America designed for the introduction and development of young Motocross and Trial riders! Four excellent racetracks and motorcycling training schools now have world-class electric motorcycles available for their classes, courses, and training sessions. Make sure to contact and visit them! We are very thankful to our customers, partners, dealers and sales teams, racetracks and instructors, and Colombia´s national, regional, and local motorcycling authorities, for trusting us. Through actions, not words, we are building and supporting the future of our country , offering kids the best, safest and most fun initiation into the two-wheel electric vehicles space! Best of luck and many successful new riding adventures!

El pasado Domingo 24 de Abril de 2022, en el marco de prácticas clasificatorias de la I Válida del Campeonato Andino de Motocross, se realizó una Evaluación Oficial y Prueba Cronometrada de la motocicleta eléctrica Torrot Motocross Two con el gran Campeón Latinoamericano y Nacional 2021 categoría 50cc, Martín Ospina Cuello, joven piloto en formación en la Pista La Laguna . Nuestras felicitaciones a los organizadores, la Liga de Motociclismo de Bogotá, la Liga de Motociclismo de Cundinamarca y la Pista la Laguna. Gran organización y asistencia!

El pasado Sábado 26 de Marzo de 2022, en el marco de prácticas libres de la II Válida del Campeonato Nacional de Motocross Colombia 2022, se realizó una Evaluación Oficial y Prueba Cronometrada de la motocicleta eléctrica Torrot Motocross Two con el gran Campeón Latinoamericano y Nacional 2021 categoría 50cc, Martín Ospina Cuello, joven piloto en formación en la Pista La Laguna . Extendemos un especial y sincero agradecimiento a la Liga de Motociclismo de Bogotá, la Federacion Colombiana de Motociclismo , y la Comisión Nacional de Motocross, por su excelente tarea y gentil invitación para ser parte de esta gran fiesta del Motocross Colombiano. A nivel mundial y en Colombia, cada vez más jóvenes pilotos están considerando motocicletas eléctricas como una alternativa de vehículo para desarrollar su destreza y técnicas de conducción. Ha sido demostrado que las motos eléctricas son una excelente alternativa y complemento para contribuir y acelerar la iniciación y capacitación de más niños y niñas en el motociclismo deportivo, Motocross, Enduro, Trial y Supermotard, de una manera segura, divertida y pedagógica.

El pasado Sábado 5 de Febrero de 2022, 15 niñas y niños que nunca antes se habían montado en una moto, vivieron la mejor, más divertida y segura, y eléctrica iniciación en el mundo de las motos en Colombia! La gran experiencia " Mi Primera Vez en una Moto ”, permitió que niñ@s conocieran los fundamentos técnicos de dos modalidades del motociclismo: Motocross y Trial. La combinación y práctica de estas modalidades es la base sólida de los grandes pilotos. Con el equipo de protección puesto, que incluía casco, uniforme, guantes y botas, los niñ@s recibieron una excelente instrucción y clase personalizada. Conocieron sobre el funcionamiento y correcto uso de la motocicleta y vivieron sus primeras sensaciones en el mundo de las motos con Torrot KIDS, la #1 moto eléctrica a nivel mundial. Los jóvenes pilotos rodaron durante 40 minutos tanto en el óvalo de Motocross Enduro como en la pista de Trial. Mientras tanto, los padres y madres aprendieron sobre la teconología de punta Europea detrás de estos vehículos eléctricos, la cual está marcando la pauta para el sector de movilidad eléctrica. Tal es caso de especificaciones técnicas de las motocicletas, como la Aplicación Móvil APP de Control Parental, el Sistema de Gestión de Batería de Litio 48V Extraíble, y la Personalización de la potencia, velocidad, acelerador y freno regenerativo de la moto según las destrezas del niño o niña. Síguenos y conoce más en nuestras redes sociales, Instagram , Twitter y YouTube .

Empezamos el 2022 a lo grande con una invitación a vivir la gran experiencia “Mi Primera Vez en una Moto”. La cita es el próximo Sábado 5 de Febrero en la Pista OffRoad ubicada en el KM 25, Autopista Norte, La Vereda Yerbabuena, Chía, Cundinamarca (ver ubicación aquí ) Torrot KIDS es la moto líder a nivel mundial para los más pequeños. Su proyecto de ingeniería, diseño, alta calidad de componentes, tecnología de punta Europea y versatilidad de manejo, permite que niños rueden y desarrollen su pasión por las motos. Para uso recreativo, estilo de vida, o competencia del más alto nivel. En la Pista Offroad tendremos un excelente espacio, instrucción y clase personalizada, para que tus hijos o hijas puedan vivir su primera experiencia y sentir sus primeras sensaciones en el mundo de las motos de una manera divertida en un espacio seguro y profesional. En “Mi Primera Vez en una Moto” los niñ@s podrán experimentar dos modalidades del motociclismo: Motocross y Trial. Mientras los niños ruedan en el óvalo de Motocross Enduro o sobrepasan obstáculos en la pista de Trial, los padres y madres podrán conocer y apreciar el App de Control Parental, el Sistema de Gestión de Batería de Litio 48V Extraíble, y la Personalización de la potencia, velocidad, acelerador y freno regenerativo de la moto según las destrezas de sus hijo o hija. Reserva to cupo ahora para compartir de un tiempo de aprendizaje, nuevos amigos y mucha diversión al lado de las motocicletas eléctricas Torrot KIDS, la #1 moto eléctrica infantil. ¡Te esperamos! Descripción : Experiencia : “Mi Primera Vez en una Moto” Fecha : Sábado 5 de Febrero 2022 Lugar : Pista Offroad (ver ubicación aquí ) Hora : 10:00 AM – 2:00 PM Reservaciones : Cupos cada 40 mins. Cambio de moto (Motocross Two y Trial Two) a la mitad del turno. Precio por Niñ@ : $50.000 COP. Incluye instructor y clase personalizada, uso exclusivo de motos eléctricas Torrot KIDS Motocross Two y Trial Two, equipo de protección y derecho de pista. Requisitos : Niñas y niños entre 6 y 11 años. Básico saber montar en bicicleta y tener sentido de equilibrio. Asistir con documento de identidad original. Diligenciar documento de exoneración de responsabilidad (en el día). Favor presentarse 25 minutos antes de la hora de la reserva.

El pasado 16 y 17 de Octubre de 2021, se realizó la 2nd VALIDA DISTRITAL DE MOTOCROSS en la ciudad de Bogotá, D.C., Colombia organizada por la Liga de Motociclismo de Bogotá y la Federación Colombiana de Motociclismo . Muchas gracias a los organizadores por invitarnos a vincularnos y patrocinar este evento. Agradecemos y valoramos la gran dedicación y trabajo del equipo organizador. Estamos comprometidos a apoyar y contribuir a la capacitación de los más pequeños y darles mayor visibilidad a los procesos de semilleros del país. Desde los más pequeños que aprenden por primera vez a conducir una moto, pasando por niños y niñas que se divierten con la moto de manera recreativa en las fincas, casas de campo, clubes campestres, trochas, etc., hasta los jóvenes pilotos que desarrollan y afinan sus destrezas y técnica de conducción para competencias a nivel distrital, nacional e internacional, Torrot KIDS es la moto líder a nivel mundial para niños y niñas de 3 a 12 años. Cada día, más y más niñas y niños están apreciando y gozando de la calidad y las ventajas de las motocicletas eléctricas Torrot KIDS. Desde sus componentes, la aplicación tecnológica móvil, hasta las sensaciones y la versatilidad que las motos ofrecen a los pilotos jóvenes en el desarrollo de sus destrezas y técnicas de conducción y manejo. ¡Muchas felicitaciones a los más de 40 participantes y los jóvenes pilotos campeones en las categorías Pitbike Infantil, 50cc Mini, 50cc, 65cc Novatos, 65cc y 85cc! Y grandes noticias nos esperan… muy pronto tendremos a Torrot KIDS Motocross ONE y Torrot KIDS Motocross TWO participando y compitiendo! Síguenos y no te pierdas estas noticias.

El pasado 9 y 10 de Octubre, se realizó la 5ta VALIDA NACIONAL DEL CAMPEONATO DE MOTOCROSS COLOMBIA en la ciudad de Manizales, Caldas, organizada por la Liga Caldense de Motociclismo y la Federación Colombiana de Motociclismo . Torrot Electric Europa y Prowess Global Group, representante exclusivo de Torrot KIDS para Colombia, agradecemos muy especialmente a los organizadores la oportunidad de poder vincularnos y patrocinar la realización de esta válida. Casi 50 niños y niñas orgullosamente representaron a la Liga Antioqueña de Motociclismo , Liga Valle de Motociclismo , Liga de Motociclismo de Bogotá , Liga de Motociclismo del Tolima , Liga de Motociclismo de César , Liga de Motociclismo de Cundinamarca , Liga de Motociclismo del Huila , Liga de Motociclismo de Nariño y Liga Santandereana de Motociclismo . Nuestros sinceros agradecimientos a todos los niños y niñas que disfrutaron de las pruebas de manejo. Desde los chicos y chicas que nunca se habían montado en una moto, hasta los experimentados jóvenes pilotos actualmente triunfando a nivel Nacional y Latinoamericano, todos se gozaron las motocicletas eléctricas Torrot KIDS con excelentes comentarios. Su versatilidad de manejo, mayor torque y potencia (además programable), menos peso (hasta 50% más ligeras), y tecnología de punta Europea, entre otros factores, hacen que Torrot KIDS sea la moto eléctrica líder a nivel mundial para los pilotos entre 3 y 12 años. Hoy, quisiéramos rendirles un pequeño homenaje a todos ellos. Muchas gracias por confiar en nosotros. Con ustedes, estamos convencidos de que el futuro del motocross Colombiano está en excelentes manos. ¡Muchos éxitos y siempre adelante! Síguenos y conoce más en Instagram @prowessglobalgroup y Twitter @Prowess_Global.